Credit outlook: Comfortably Numb

As Pink Floyd reminded us with Comfortably Numb, detachment can feel safe in the moment – but it risks leaving us unprepared when reality finally breaks through. Credit markets today seem to embody that same paradox.

概要

- Spreads are extremely tight, but investors remain upbeat

- Strong technicals provide ongoing support

- Focus on quality IG and disciplined HY exposure

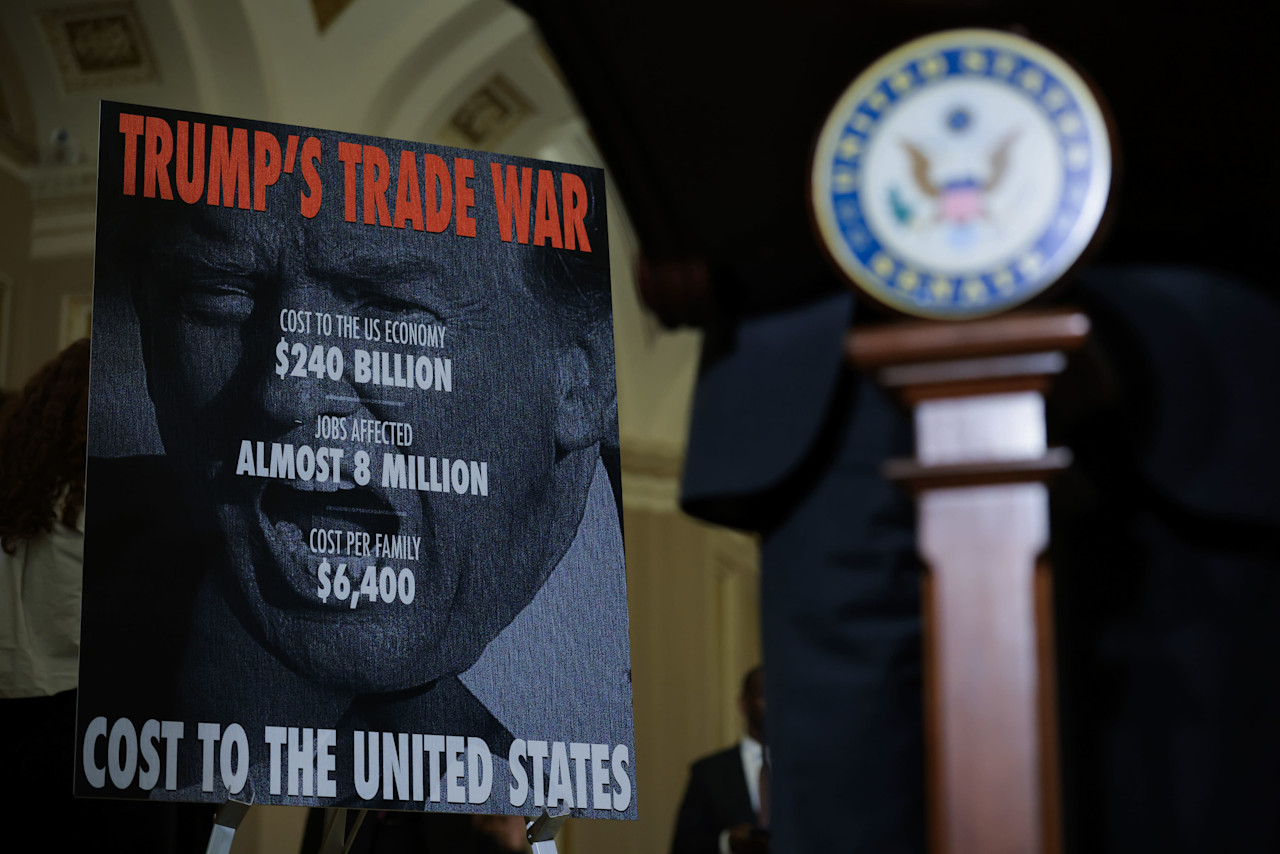

Even Trump’s increasingly assertive influence over the Fed, once unthinkable, failed to shake sentiment. Downward revisions in labor market data, combined with leading indicators pointing to renewed inflationary pressure, have raised the odds of a stagflation scenario, yet even these developments have failed to dent risk appetite. After several false alarms, where spreads widened on recession fears that never materialized, investors feel little appetite to put on hedges again.

The result is a credit market that feels, to borrow from Pink Floyd, ‘comfortably numb’. Investors remain comfortably long, detached from risk, and seemingly indifferent to the warning signs around them. Complacency, it seems, has become the prevailing mood.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.