Japan's Green Transformation Plan to boost smart energy investments

Japan’s Green Transformation (GX) Plan is a bold new strategy aimed at transitioning the world’s fourth largest economy away from fossil fuels and toward cleaner energy sources. Equally ambitious financing should catalyze investments across diverse smart energy solutions, from renewables and smart grids to smart cars and energy-saving equipment.

概要

- Plan aims to both energize and decarbonize Japan’s economy

- The near 1 trillion-euro investment rivals the US IRA in size and ambition

- Substantial tailwinds expected for smart energy solutions in Asia and Japan

Japan’s momentous move was motivated by the need to decarbonize the economy to combat climate change, ensure energy security, spur green innovation and clean economic growth. Though it has made some progress in the two decades since the enactment of the Kyoto Protocol (the world’s first legally binding climate treaty), Japan still ranks fifth in global emissions and performs worse than China in emissions per capita.1

Part of the problem is a heavy reliance on fossil fuels (nearly 100% of which are imported) which the GX Plan aims to reduce through generous investments in clean technologies and negative taxes on carbon. 2

Figure 1 – Japan wants to kick its fossil fuel habit

The bulk of Japan’s energy supplies stems from fossil fuels, which are almost fully imported. Source: Energy mix from Japan’s 7th Strategic Energy Plan, Agency for Natural Resources and Energy, UBS, 2025. Climate Bonds Initiative, 2024.

To achieve its goals, nearly 1 trillion euros in investments will be raised over the next decade through public and private sources.3 The goal is to first incentivize companies to innovate their way toward a net-zero trajectory before applying penalties on laggards.

Nearly 1 trillion euros in investments will be raised over the next decade through public and private sources

Japan’s GX rivals US IRA

The comprehensiveness of the roadmap combined with extraordinary scale of financing – which is more than 3 times larger than the US Inflation Reduction Act (IRA) as a share of country GDP – demonstrates Japan’s credible commitment to using the net-zero transition to rev up innovation and future economic growth.

Figure 2 – Japan GX Plan vs US IRA

Japan’s annual public spending on clean energy investments is 3x larger than the US’s IRA in terms of GDP. Source: US Senate; Rhodium Group; GR Japan; Statista; Jefferies, 2024.

As with the IRA in the US, the GX plan is designed to facilitate the clean shift through substantial investments in renewable energy, electric vehicles, and improvements in energy efficiency for buildings and infrastructure. The IRA experience in the US suggests that Japan’s initiative could generate beneficial tailwinds for companies within these industries.

Since the IRA enactment, investments in manufacturing and deployment of clean technologies reached USD 493 billion – a 70% increase compared to pre-IRA levels.4 Investments in emissions-reducing technologies in Q2 2024 alone represented 5.5% of all US private investments (see Figure 3).5

Growth and earnings resulting from company capex into clean and emissions-reducing technologies should continue to steadily unfold as deployment and adoption increase in the years ahead.

Figure 3 – US IRA has helped push private investments into clean energy solutions

The graph shows clean investments as a share of total US private investment in structures, equipment and durable consumer goods. Source: Rhodium Group/MIT-CEEPR Clean Investment Monitor, 2024.

Japan issues world’s first ‘green govies’

A key component of the funding strategy is the issuance of EUR 131.5 billion in climate transition bonds over the next ten years.6 These transition bonds, or ‘green govies’, are meant to kickstart the investment cycle. All other financing (around EUR 855 billion) will come from a mixture of private financing, emissions pricing and a carbon levy on fossil fuel imports.

The plan is also noteworthy for its emphasis on transitioning without derailing Japan’s overall economic growth. It’s hoped that this strong initial signal combined with seed funding should help steer companies toward reducing emissions.

Proceeds from financing will be allocated to various green initiatives including decarbonizing the energy sector, supporting renewable technologies, and promoting energy efficiency in housing and buildings. Later funding will come from carbon pricing and fossil import levies which should also pressure companies to invest in decarbonizing solutions.

Leveraging its ‘league’ and leadership

Another unique twist is the creation of a ‘GX League’, a voluntary group of nearly 750 of Japan’s high-emitting companies, that will pilot the emissions pricing mechanism to work out kinks before it goes mandatory in 2026. The league could also be critical for unlocking capex toward decarbonizing strategies from key industry players across Japan’s economy.

It’s a smart move, as Japan’s lead in hydrogen fuels cells, automotive batteries, semiconductors, and electronic equipment gives it a head start in innovating and scaling low-carbon solutions across many industries. Japan intends to leverage its expertise to decarbonize its economy and also create a clean tech engine to spur economic growth and leadership in Asia – a space now dominated by China.

Smart Energy D EUR

- performance ytd

- 8.63%

- Performance 3y

- 6.18%

- 晨星評級

過往表現未必可作日後業績的準則。投資價值可能會波動。

One great investment strategy deserves another

Like the GX Plan, the Robeco Smart Energy Strategy (the Strategy) applies a comprehensive, multi-sector approach to investing in decarbonization. From upstream energy generation via renewables to downstream consumption from consumers and industrial users, the Strategy invests in the same target areas and companies poised to benefit from the GX spending, many of which are local names and lesser known internationally.

Figure 4 – Investing along a multi-trillion-dollar clean energy value chain

Source: Robeco, Smart Energy Strategy, 2025

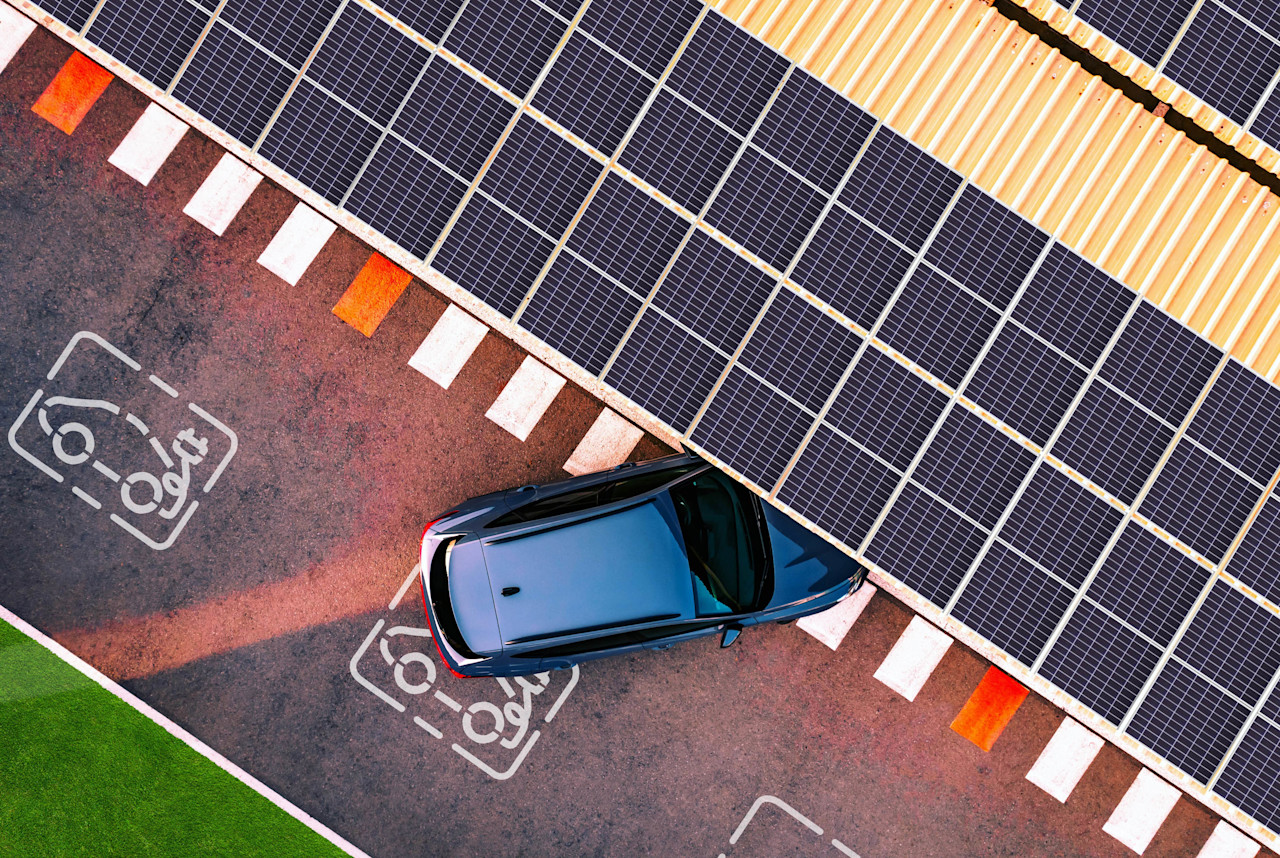

The GX Plan stipulates that electric vehicles must comprise 20% of all new car sales by 2030, which should notably advance the development and adoption of electric vehicles, batteries, and automotive semiconductors – key components of the Strategy’s energy efficiency and power management clusters. And with a goal of 36-38% renewables in the energy mix, renewable generation should also see substantial growth, lifting the performance potential of the Strategy’s renewable holdings.

Figure 5 – GX Plan investments by sectors

Transportation and renewable energy generation account for over half of planned investments. Source: Jefferies, METI, GR Japan, 2024.

Grid operators and suppliers should benefit from upgrades and expansion that facilitate renewable integration as well as meet the rising power needs of next-generation chips and hyper-scaled data centers. Already in 2024 alone, no less than 27 grid-scale battery and energy storage projects valued at EUR 217 million were approved by municipalities to enhance transmission grids from Hokkaido, Tohoku, and Tokyo in the north, to Chubu, Kansai and Kyushu in the south.7

Promoting sustainable living environments is also a key GX-objective which will benefit companies specializing in energy-efficient construction materials, insulation, and smart-home technologies, providing tailwinds for companies within the Strategy’s energy efficiency cluster.

Conclusion

The GX plan is comprehensive, competitive, and sustainable. Robeco’s Smart Energy strategy employs a similar approach, leaving it well positioned to benefit from the attractive opportunities created by Japan’s once-in-a-century transformation.

Footnotes

1 Japan - Countries & Regions - IEA

2 Climate Bonds Initiative

3 EUR 986.5 billion or JPY 150 trillion. Converted using Japan’s average EUR/YEN exchange rate over FY 2023 (1 EUR = 152.04 JPY), the year the GX Plan was announced. Source: World Currency Exchange Rates

4 Investment reached USD 493 billion in the two years post-IRA compared to USD 288 billion in the two years pre-IRA.

5 Clean Investment Monitor, August 2024. Rhodium Group, MIT Center for Energy and Environmental Policy Research.

6 EUR 131.5 billion = JPY 20 trillion. The first issuance JPY 1.6 trillion with 5 and 10-year maturities was in February 2024. Conversion done using EUR/YEN exchange rate over FY 2023 (1 EUR = 152.04 JPY), the year the GX Plan was announced. Source: World Currency Exchange Rates

7 Japan Energy Hub. January 2025. 27 grid-scale BESS projects secure 34.6B yen through METI's FY2024 storage subsidy program. Conversion rate of 1 EUR = 159.28 JPY, the average rate over FY 2024. Source: World Currency Exchange Rates

了解最新的可持續性市場觀點

訂閱我們的電子報,探索塑造可持續投資的趨勢。

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.