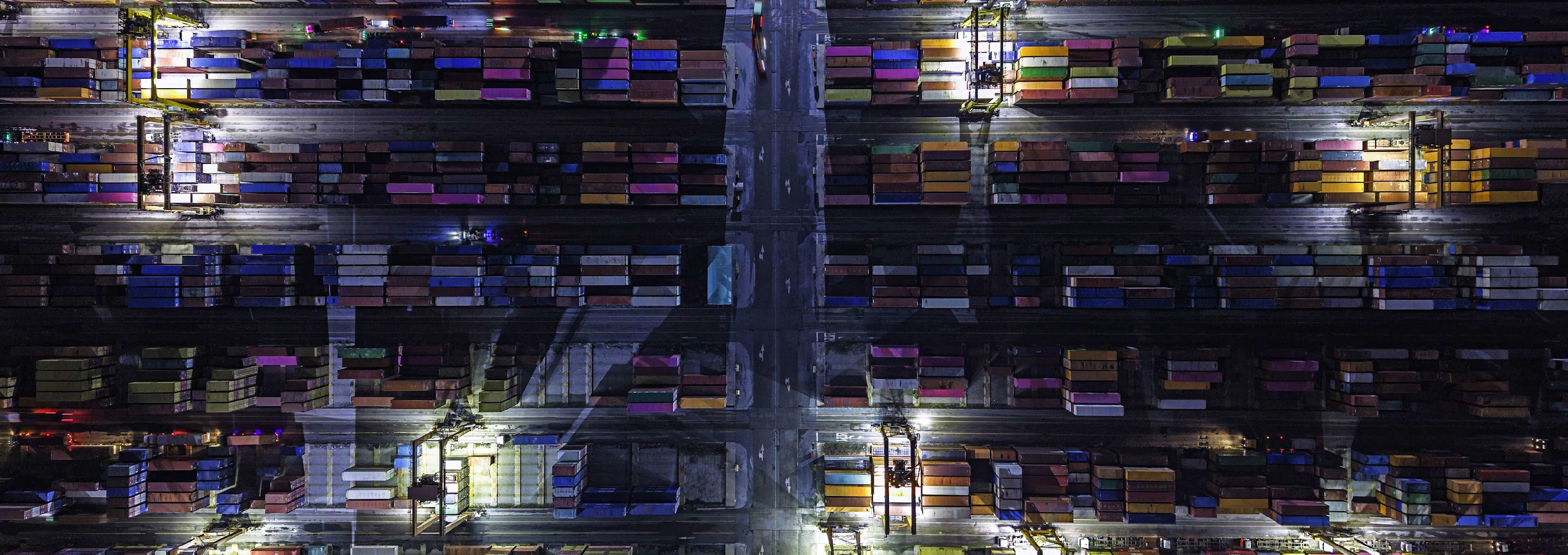

Targeting alpha in a global trade revolution

The trade war started by the new US government has prompted a severe stock market sell-off as economic confidence recedes amid uncertainty over the re-organization of complex global supply chains. This paradigm shift in trading conditions requires a more balanced global equity allocation to both developed and emerging markets.

Summary

- US exceptionalism is in question, even if Trump’s trade war is contained

- Long-term alpha generation will demand a more global footprint

- Rebalancing away from US assets and USD weakness will bolster EM

‘Liberation day’ on 2 April has had two impacts which will be enduring. First, US exceptionalism took a serious blow, with the imposition of sweeping global tariffs certain to drive US inflation, weaken the US economy and make it more difficult for leading US multinationals to operate globally. Second, the impact on the global economy ex-US will be deflationary, with lower demand and overcapacity in some sectors likely to manifest itself rapidly, with negative short-to-medium-term macroeconomic aftershocks.

At the time of President Trump’s inauguration, US equity market dominance had reached its zenith with the US accounting for 64% of the MSCI All World Index while the country accounts for 15.5% of global GDP in 2024.1

Figure 1: MSCI World is dominated by US companies

Source: MSCI. The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 24 emerging markets (EM) countries. With 2,558 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Global Stars Equities D EUR

- performance ytd (30-11)

- 1.41%

- Performance 3y (30-11)

- 12.53%

- morningstar (30-11)

- SFDR (30-11)

- Article 8

- Dividend Paying (30-11)

- No

Valuations also reflected this dominance, with the US CAPE ratio on 31 March 2025 at 32.8, compared to an average of 19 for developed markets (DM) and an average of 14 for emerging markets (EM).2 This US valuation premium seems certain to narrow as the US rewrites the rules of global competition.T

Read the complete insight and get our analysis of where to invest in this new global trading landscape.

Footnotes

1Source: Statista based on a Purchasing Power Parity measure of estimated 2024 GDP.

21Q25 Global Valuations – The Idea Farm - 8 April 2025. The CAPE ratio (cyclically adjusted price-to-earnings ratio), assesses whether the market is overvalued or undervalued by comparing current prices to average earnings over a 10-year period, adjusted for inflation.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.