Digital Innovations

Targeting the winners of AI

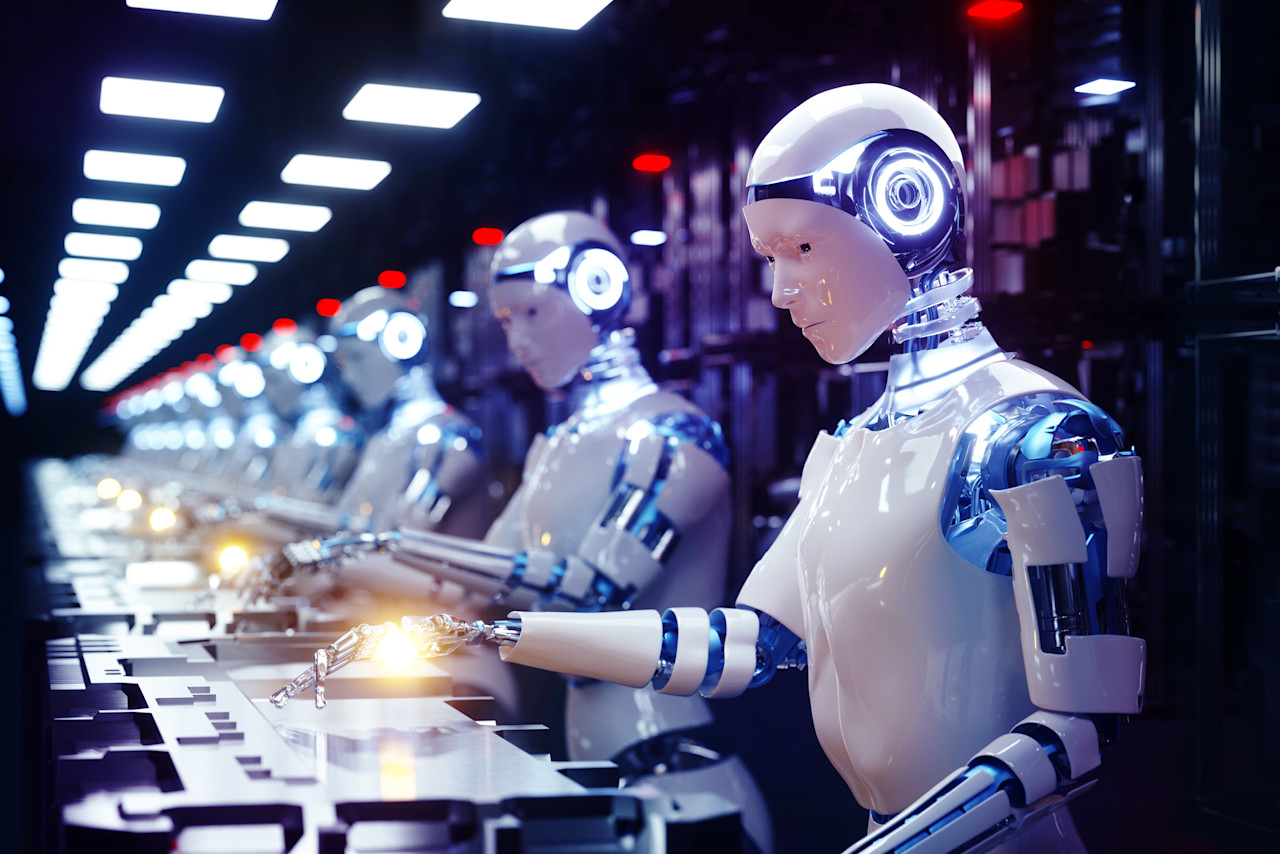

Targeting the winners of AI Investing in companies at the forefront of the AI revolution: those developing the software, hardware, and platforms powering future innovation. The Digital Innovations Strategy is capturing growth across the entire AI ecosystem. That means investments in semiconductor design and manufacturing as well cloud-computing platforms and software developers that help to deploy its powers to automate business processes.

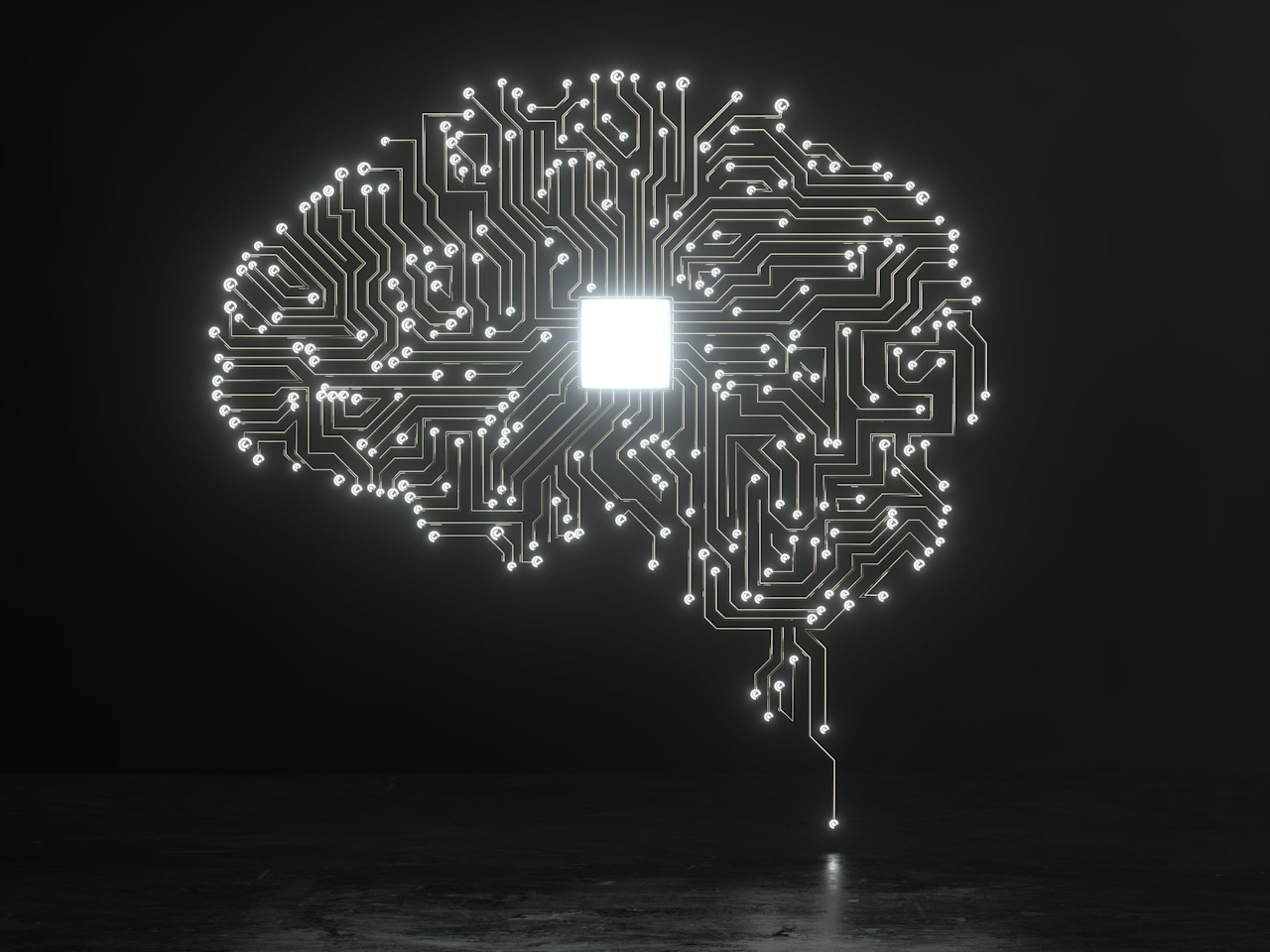

Yet, AI is much bigger than IT.

Though born out of Big Tech, AI’s transformative power will continue to reach far beyond its IT roots. A mind-boggling capacity to rapidly structure data, discover patterns and solve problems means AI is already transforming sectors and industries.