The role of government bond investors in funding the SDGs

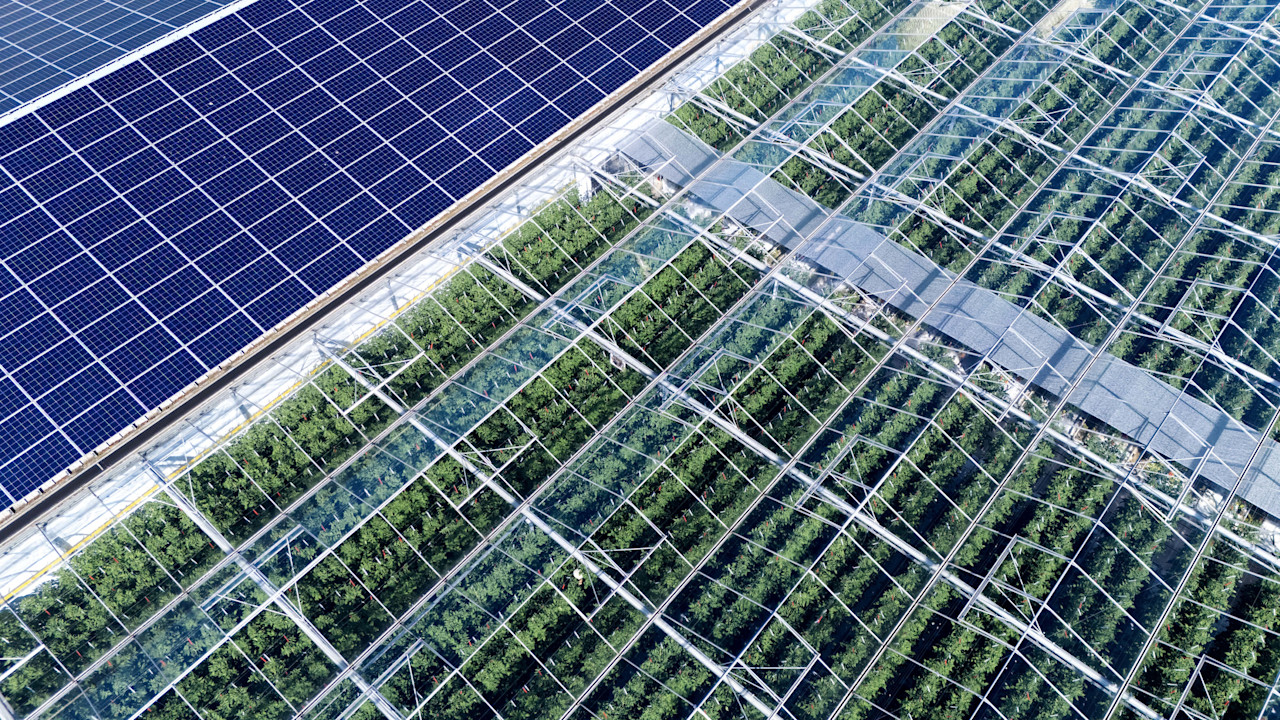

Integrating the Sustainable Development Goals (SDGs) into government bond portfolios is a relatively new frontier for investors. Robeco uses its proprietary Country SDG Framework to assess countries on their policies to achieve the SDGs, their need for capital to finance sustainable development, and their adherence to key sustainability principles.

In an update to a research paper first published in February 2023, our quant, fixed income and SDG experts show how such a framework can be practically applied in developed and emerging government bond portfolios. The new and updated parts are:

Summary

- A new section on the relationship between CDS spreads and SDG scores

- A focus on the four most important government bond benchmark indices

- Analysis of historical returns, showing that performances are not significantly affected

Contrary to existing approaches, this method does not lead to government bond portfolios that primarily consist of extremely safe countries with low interest rates that already have achieved many SDG. This approach can therefore enable investors to help close the financing gap for the SDGs.

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.